Successful customer experiences and a steady cash flow are the keys to thriving in the tour planning industry.

However, managing these two can present several challenges. Presenting customers with high upfront costs can overwhelm them. It’s better to break these costs into manageable vacation packages to make your trips appear more appealing and accessible.

A well-designed payment plan allows customers to spread their expenses and enjoy the experiences you offer.

To streamline payment management for your tour plan company, consider SquadTrip. Its automated billings and customizable payment plan features help you save time, so you can focus on planning unforgettable trips for your customers.

This article is your go-to guide to creating effective payment options and automated billings that boost your revenue and business growth.

Types of Tour Payment Plans

Tour planners should provide the right payment options to meet the diverse needs of their customers. You can offer fixed or flexible installments, subscriptions, or customizable plans that make your trips more affordable.

1. Installment Plans

Installments can vary depending on your tour requirements. You can fix the payments over a specific period leading to or after the trip to ensure clients pay within the duration.

Here are a few categories to set your installment plan:

- Fixed Installments: You set up a fixed amount that the client has to pay over a period of time until the amount is fully paid.

- Flexible Installments: This allows you to give your clients some flexibility in the remaining pending balance after the upfront payment is paid.

- Balloon Payments: Clients can pay small monthly payments with a larger final payment towards the end of the plan.

- BNPL: Buy Now, Pay Later allows customers to book now and then pay monthly to cover their expenses.

2. Subscription Based Plans

Unlike installments, subscription plans require clients to pay recurring fees to gain access to trip discounts and deals. Subscribed members can avail of perks such as priority booking, free cancellation, or special member-only discounts.

This helps tour planners build long-term client relationships and create memorable getaway experiences. Improved customer trust and loyalty also help attract more clients and grow your business.

3. Customizable Plans

You can customize payment plans to provide maximum flexibility to your clients. When customizing a dream vacation for your clients, you can tailor the payment plan to align with their financial situation.

This includes adjusting monthly installments, and payment dates or finalizing prepayment penalties. Flexible and customizable plans show clients that you are open to working with their needs and improving their overall experience.

How to Integrate Payment Plans into Trip Operations?

Here are a few steps to help you seamlessly integrate payment plans into your travel business operations:

1. Set Up a Merchant Account

A merchant account allows travel agencies and tour planners to receive digital payments seamlessly. This dedicated account also lets you organize and manage the collected money without hassle.

You can process debit/credit card payments, bank transfers, eChecks, and other online transactions through this account to cater to all your trip expenses.

Choose a merchant account provider with extensive security features and financial compliance. This ensures you have a reliable system to manage your payment plans whenever needed.

2. Design a Payment Structure

If you are planning multiple trips for your clients, it is best to decide the type of payment structure that suits your business model. You can use different types of plans such as a monthly payment plan, one-time payment, or a combination of down payments and regular installments.

You must also finalize some of the payment terms. These may include payments at the time of booking, the application of compound interest, late fee charges, eligibility criteria, and considerations such as credit scores and credit checks. Once all payment terms are in place, you can ensure no discrepancy in the traveling experience.

3. Streamline Payment Processing

Handling client payments can be stressful when you have to manage everything manually or constantly follow up with clients to remind them of their installment payments.

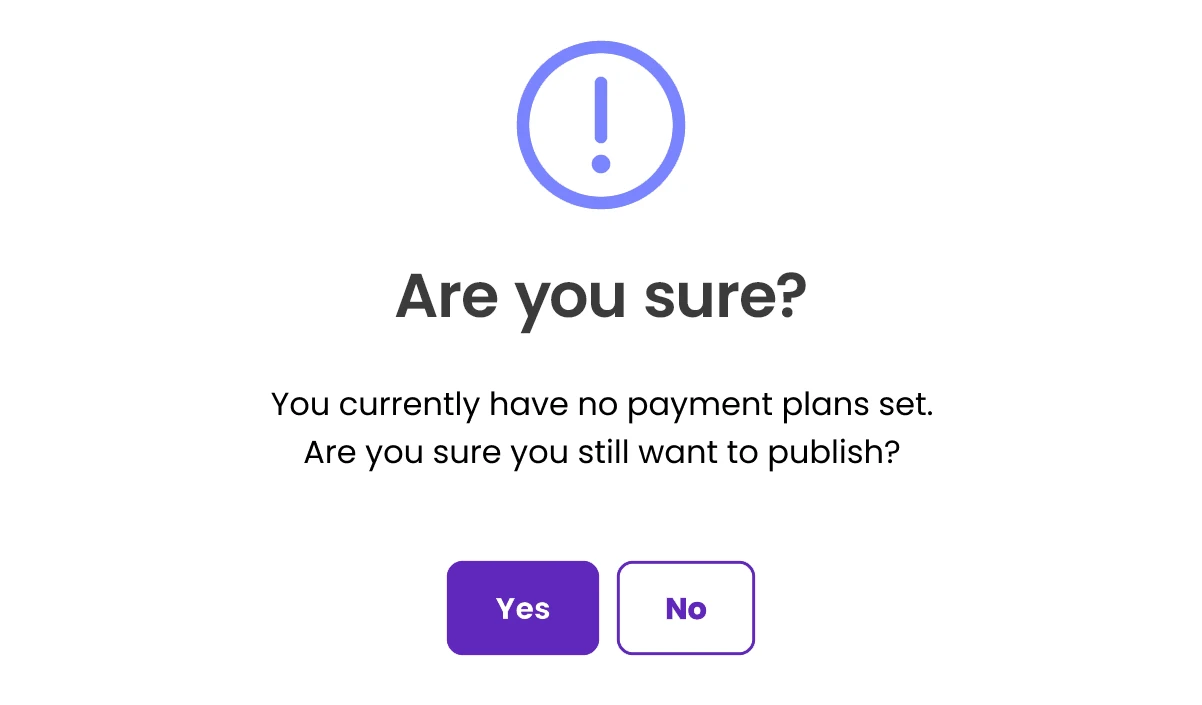

Using a trip management platform like SquadTrip ensures efficiency by providing autopay options, automatic payment reminder notifications, and customizable plans.

The platform not only eases the logistical burdens but also provides your clients with a seamless trip-booking experience.

4. Be Transparent with Clients

When sharing trip details with clients, it’s important to clearly outline the available payment options and terms. To ensure transparency, include detailed information about your payment plans in the trip details FAQ section. Communicating with your clients builds trust and helps them make a quick decision.

With SquadTrip, you can create dedicated pages for each trip and outline their details accordingly. It allows you to share all payment-related information within the trip page for improved transparency.

5. Monitor Your Payment Plans Regularly

It’s essential to monitor how well your payment structures are performing. Evaluate your business’s financial performance and client feedback to discover what works best and what needs improvement.

Optimizing your payment plans helps you optimize your business operations, bring in new clients, and boost profits.

Simplify Your Payment Plans with SquadTrip

With customizable travel packages, flexible deposits, auto-billings, and automated fee handling, SquadTrip makes managing payment plans effortless. Moreover, you can use the portal to track and monitor ongoing payment processes, ensuring you never miss a payment or get stuck in financial bottlenecks.

Create your trip for free and see how easy it is to streamline your payment process.

FAQs

What are the typical terms for a travel payment plan?

The most essential payment terms include the initial deposit amount, installment amount, payment schedules, interest rates, late fees, and eligibility criteria.

What are the benefits of vacation payment plans for a tour planning company?

Setting up vacation payment plans can increase your bookings as they may appear affordable to the clients. This would improve your business’s revenue and cash flow.

Can clients use loans to pay for their trips?

Yes, some tour planning companies partner with third-party lenders to offer loan terms. This allows clients to travel now and later pay off their with low monthly payments.

Read Next: