Managing billing and attracting customers in the travel industry can be challenging. With high costs, many potential clients hesitate to commit, and you might find yourself juggling different payment options or waiting for checks to clear.

But here’s the solution: offer payment plans to your customers. These plans can turn your travel big-ticket items and packages into manageable weekly or monthly payments, or installments. By doing so, you open the door to new clients who might otherwise shy away from upfront costs.

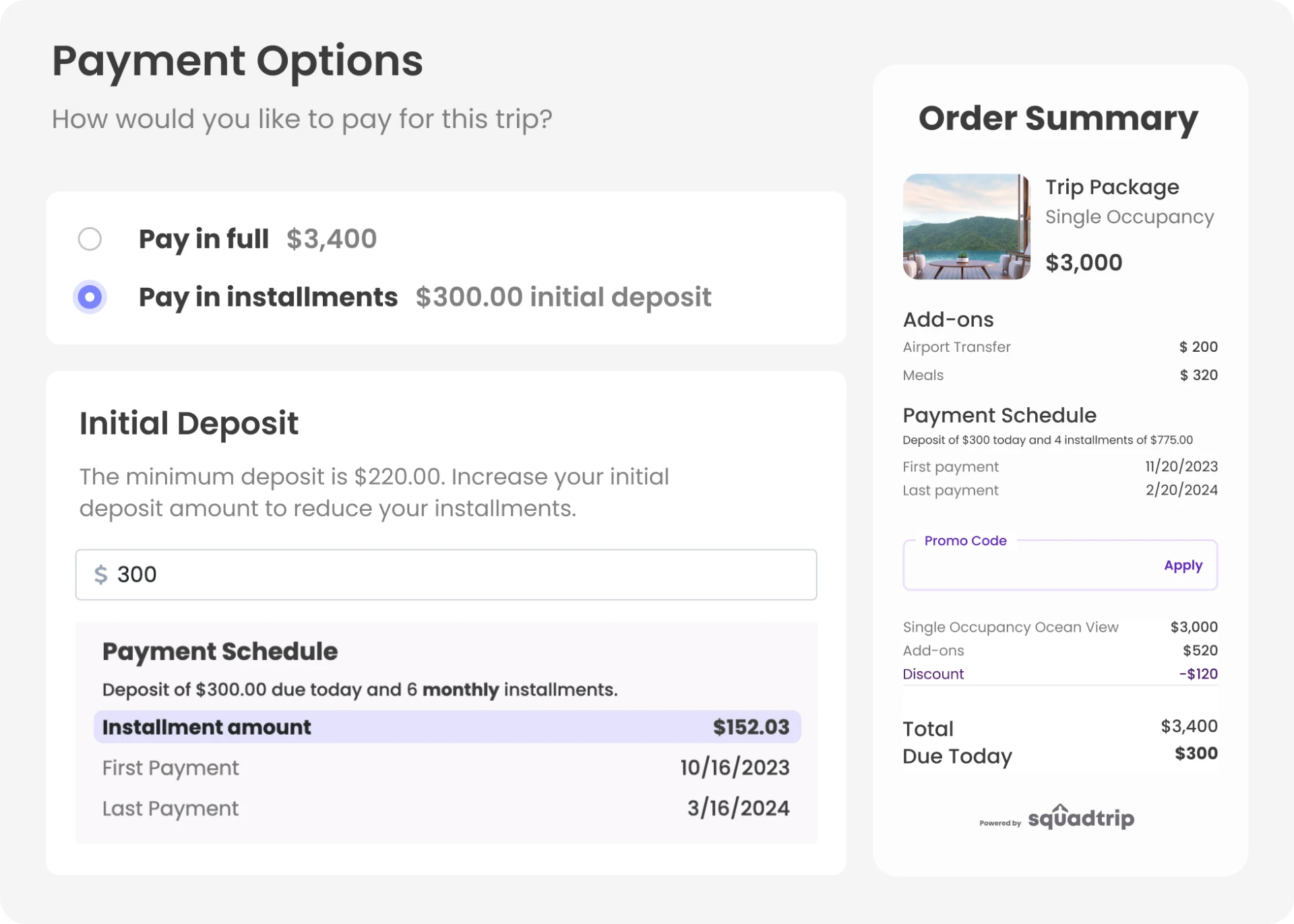

You can take it a step further by automating your payment processing with SquadTrip. With monthly auto-billing, SquadTrip saves you time by automating invoicing and spreading payments throughout the trip. Additionally, you can set up flexible deposit options, allowing customers to pay a minimum deposit upfront and schedule the rest in manageable installments.

This article breaks down the process of setting up payment plans, helping you take the best approach and maximize the benefit.

Reasons to Offer Payment Plans to Customers

The advantages of payment plans go beyond just offering you a payment solution. By implementing payment plans, you as a business owner can unlock several key benefits for both your company and your clients.

More Bookings

Travel is a significant expense, and many potential customers hesitate to book due to the high upfront costs. By offering flexible payment plans, you make your services more accessible, encouraging more travelers to commit. For instance, a customer who might not be inclined toward a $5,000 vacation package could be more interested in booking if they can pay in manageable installments.

Improved Cash Flow

Payment plans can also stabilize your company’s cash flow. Instead of relying on occasional large payments, you benefit from a steady income stream spread over time. This is particularly useful if your travel company offers expensive packages, as it helps cushion the impact of seasonal fluctuations or one-time expenses.

SquadTrip’s monthly auto-billing, customer-scheduled emails, and automated reminders help you keep payments on track.

Higher Average Order Value

When customers can pay in installments, they’re often willing to spend more. For example, a client may choose a luxury suite instead of a standard room or add on excursions and services that they might have skipped if they had to pay the full amount upfront. This flexibility boosts the overall transaction value, leading to higher revenue for a small business.

Customer Satisfaction and Loyalty

Customers value flexibility, especially when it comes to payment options like credit cards, debit cards, and online payments. By providing payment plans, you not only meet their needs but also build stronger relationships. When you have satisfied new customers, they are more likely to return and recommend your services to others.

Types of Payment Plans You Can Offer

Let’s explore some specific types of payment plan options that your travel company can offer:

- Subscription Plans: Subscription plans allow customers to make recurring payments—monthly or yearly—for access to your service. This model is especially useful if your travel company is offering exclusive packages or memberships with discounted trips, priority booking, or special events.

- Installment Plans: Installment payments are a straightforward option for customers to pay for their travel over time. Instead of paying the full amount upfront, they make fixed monthly payments until the balance is cleared. For instance, if a client books a $2,000 vacation package, they could pay around$330 per month over six months.

- Buy Now Pay Later (BNPL): BNPL is a flexible payment option that lets your customers book their travel immediately without paying the full amount upfront. They can spread the cost over a series of interest-free installments. This method is particularly appealing to customers who want to secure their trip but may need a bit more time to manage the full payment schedule.

To make implementing these payment options easier, consider using a tool like SquadTrip. The platform allows you to create customized payment plans that suit your customers’ needs, helping you create a smooth and convenient booking experience.

Best Practices For Offering Payment Plans To Customers

When offering customer payment plans, following best practices can help you curate a successful experience for both you and your clients. Here are some things to keep in mind:

- Determine Eligibility: Before offering a payment plan, it’s essential to assess whether a customer is eligible. You should evaluate factors like credit score, payment history, and income. For example, if a customer has a strong credit score and stable income, they’re likely a good candidate for a payment plan.

- Set Clear Terms and Conditions: When setting up payment plans, clearly outline the payment schedule, refund policy, payment terms, interest rates (if applicable), and any penalties for late or missed payments. For instance, if a customer misses a payment, they should know what the consequences will be. Providing all the details in writing brings both parties on the same page, preventing misunderstandings and building customer loyalty.

- Choose Flexible Payment Systems: Offer a variety of payment methods to make the process convenient for your customers. Whether it’s a credit card, direct debit, afterpay, or another method, flexibility can increase the likelihood that new customers will take advantage of the payment plan.

- Establish Reasonable Fees: If your payment plan includes processing fees or add-ons for late or missed payments, make sure these costs are reasonable and clearly communicated. High fees can scare away customers from using the plan, while unclear fees can lead to dissatisfaction.

- Monitor and Adjust as Needed: Keep an eye on how your payment plans are performing. Are customers consistently meeting their payment obligations? Is the plan structure working well for your business? Regularly review and, if necessary, adjust your payment plan offerings to better meet the needs of your customers and your business.

Simplify Your Payment Process Today with SquadTrip

Ready to simplify your payment processes? Let SquadTrip handle the heavy lifting, so you can focus on what you do best—creating unforgettable travel experiences.

With SquadTrip, you get:

- Customizable Travel Packages: Easily build the right packages for your trips, from Double vs. Single to Basic vs. Premium.

- Traveler Portal: Give your guests the power to manage payments, buy add-ons, and review their itinerary through reader-friendly templates in one place.

- Flexible Deposits: Lay out minimum deposit amounts and let your customers pay more upfront if they choose.

- Monthly Auto-Billing: Save time and make trips more affordable with automatic invoicing and monthly payments.

- Fee Handling Options: Pass processing fees on to customers or include them in an all-in rate.

- Fast and Secure Payments: Easily process your customer payments through Stripe, with daily payouts getting sent directly to your bank account.

You can create your trip for free today and see how SquadTrip is an all-in-one platform that can help you manage payments in just a few clicks.