If you’ve ever searched “WeTravel payout issues” or found yourself wondering why your trip payments are stuck in limbo, you’re not alone. Many group trip organizers report frustration with delayed payouts, unclear verification steps, and funds on hold when using the WeTravel platform.

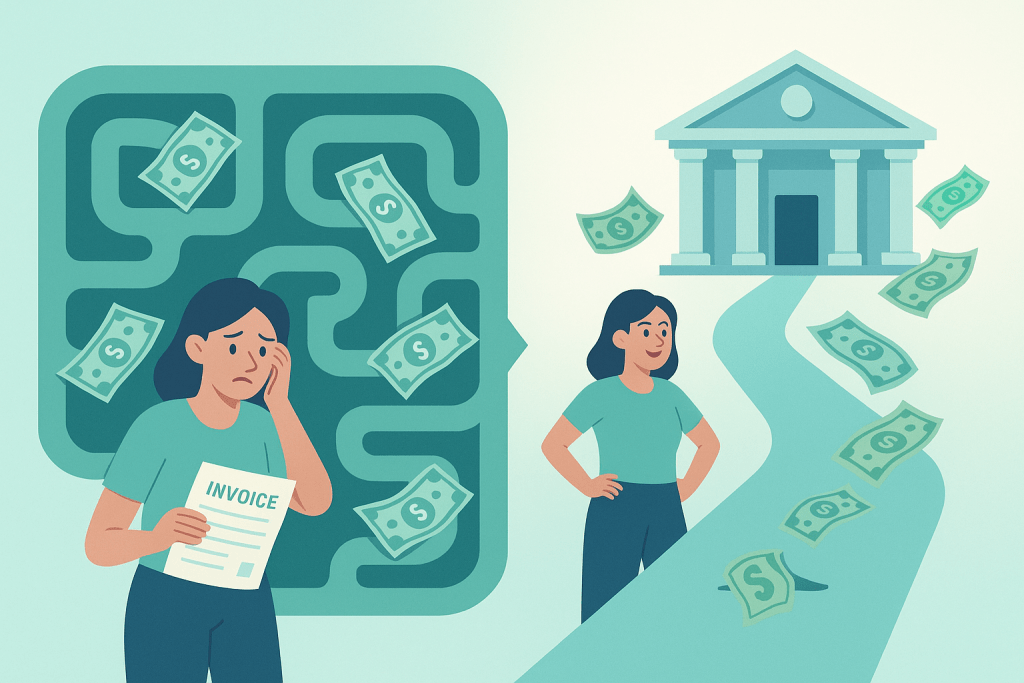

WeTravel promotes itself as a user-friendly payment platform for travel businesses, but beneath the surface, its payout paths can create real cash flow problems. Organizers are often left waiting for money they’ve already collected, navigating an opaque verification process, or discovering unexpected fees and delays.

In this guide, we’ll break down:

- How WeTravel payouts actually work.

- The details of the Stripe Standard option (and why it’s gated).

- What to expect from the account verification process and payout timelines.

- The difference between Stripe payout delays and WeTravel funds on hold.

- Common cash-flow scenarios that organizers face.

- How to switch to SquadTrip + Stripe for transparent, predictable payouts.

💡 Pro Tip: If you’re actively comparing platforms, don’t miss our full guide on the 6 Best WeTravel Alternatives in 2025.

Positioning line: SquadTrip doesn’t gate your Stripe. If you can open an account, you can get paid.

How WeTravel Payouts Work

WeTravel offers two distinct payout paths, each with its own implications for organizers.

1) Platform Funds (default path)

By default, all traveler payments flow into WeTravel’s Platform Funds. From there, the company decides when money is released into your bank account.

- Funds are held inside WeTravel’s payment system.

- You may be able to pay suppliers directly from these funds.

- Actual organizer payouts depend on WeTravel’s internal rules and schedule.

- Visibility into “available” funds is limited.

This default setup is why so many organizers search for wetravel payout issues. You’ve technically collected money, but you don’t control when it becomes available.

2) Stripe Standard Account (optional)

WeTravel advertises that you can connect a Stripe Standard account, which would allow funds to flow directly into your Stripe dashboard. That means more transparency and flexibility.

But here’s the catch:

- Stripe must be manually enabled by WeTravel.

- You’ll go through a separate account verification process with Stripe.

- Approval is inconsistent — some organizers wait weeks, others are denied without clear reasons.

For organizers, this means unpredictable timelines and limited control, even when Stripe is an option.

The Stripe Standard Option (and Why It’s Gated)

Many organizers assume that connecting Stripe is automatic. In reality, Stripe Standard is not the default for WeTravel users.

To use it, you must:

- Request enablement through WeTravel’s support team.

- Complete Stripe’s KYC verification process (identity checks, ID uploads, and possibly business documents).

- Wait for Stripe and WeTravel to finalize the connection.

Why the Gatekeeping?

WeTravel prefers keeping payments in Platform Funds because it gives them more control over:

- Payment processing

- Handling refunds and disputes

- Risk management for chargebacks

But for organizers, this creates cash flow problems:

- You don’t know when payouts will clear.

- You can’t plan vendor payments confidently.

- You face unnecessary delays in transferring money to your bank account.

This opacity drives many organizers to search for wetravel alternatives.

Verification Steps & Timelines

Once Stripe is enabled, organizers must complete the verification process. This is where delays pile up.

Stripe KYC Verification

- Partial verification: Provide basic personal information and bank details.

- Full verification: Upload government ID, proof of address, and business registration (if applicable).

Timelines

- Best case: Approval within a few business days.

- Common case: Delays of 1–3 weeks.

- Worst case: Months of waiting, with no communication about why.

During this period, organizers often still need to issue refunds to travelers or pay suppliers, even though their funds are locked. To make matters worse, some organizers discover unexpected fees deducted when payouts finally process.

The Transparency Problem

Stripe normally provides clear updates in its dashboard during KYC. But with WeTravel as the middle layer, many organizers describe the process as confusing and opaque. They’re told to “wait for Stripe” while Stripe is actually waiting on WeTravel.

Risk Holds 101 — Stripe vs. WeTravel

It’s critical to distinguish between Stripe payout delays (normal risk policies) and WeTravel funds on hold (platform-imposed delays).

Stripe Holds

- First payout: typically 7–14 days for new accounts.

- After that: daily or 2-day rolling payouts.

- Rolling reserves may apply for higher-risk accounts (like travel agencies).

- Stripe explains these holds transparently in your dashboard.

WeTravel Holds

- Money remains in Platform Funds until WeTravel releases it.

- Organizers report unexplained delayed payouts with no communication.

- Funds may be frozen during disputes, even if Stripe would normally pay.

The Key Difference

With Stripe, you may experience payout delays, but you always know why. With WeTravel, you may have transactions marked as completed, yet money doesn’t transfer to your bank account on schedule. This lack of clarity is the core of wetravel payout issues.

The Cash-Flow Scenarios

Let’s break down what this looks like in practice:

Scenario A: Platform Funds (default)

- Collect $15,000 in trip payments.

- Funds sit inside the WeTravel payment platform.

- You must pay suppliers through WeTravel.

- Payouts are released only when WeTravel approves.

Scenario B: Stripe Standard (enabled)

- Collect $15,000 in payments.

- Funds appear in Stripe, but first payout may take 7–14 days.

- After KYC is complete, payouts flow daily or every two days.

- Still subject to Stripe’s rolling reserves if flagged as high risk.

Scenario C: SquadTrip + Stripe

- Collect $15,000 in payments.

- Funds go directly into your Stripe account.

- Stripe applies only its standard payout rules.

- No extra fees, no platform-imposed delays, no “black box.”

For organizers, Scenario C offers the most predictable and transparent cash flow management.

Switching From WeTravel to SquadTrip

If you’re dealing with WeTravel payout issues, switching doesn’t have to be overwhelming. You can transition in a weekend.

Step 1: Create a Free SquadTrip Account

Sign up for free and connect your Stripe account instantly. No gating, no opaque approval.

Step 2: Build Your Trip

Recreate your trip page, set up payment processing, and configure deposits or installment plans.

Step 3: Handle Existing Payments

- If travelers already paid in WeTravel: create discount codes equal to their prior payments.

- Example: Sarah paid $400 → generate code

Sarah400. - On SquadTrip, her next payment reflects that credit.

- If no one has paid yet: publish your SquadTrip page and start collecting right away.

Step 4: Communicate Clearly

Vendor Email Template

Subject: Updated Payment Method for [Trip Name]

Hi [Vendor],

We’ve moved from WeTravel to SquadTrip to manage payments. From now on, funds will come directly from us via Stripe. Please update your records.

Thank you,

[Organizer Name]

Traveler Email Template

Subject: New Payment Link for [Trip Name]

Hi [Traveler],

We’re now using SquadTrip for payments. Any money you paid in WeTravel has been credited (code: Sarah400). Please use this new link for future payments: [Insert SquadTrip link].

Thanks for traveling with us,

[Organizer Name]

Step 5: Book a Demo if Needed Click here to book your SquadTrip demo.

FAQs About WeTravel Payouts

Does WeTravel let me use my own Stripe?

Yes, but only after you request it and complete account verification. With SquadTrip, Stripe is enabled instantly.

How long does WeTravel Stripe approval take?

It varies — some organizers wait days, others weeks or months. With SquadTrip, setup takes minutes.

Why does WeTravel hold funds?

To manage platform risk, refunds, and disputes. SquadTrip doesn’t hold your money — only Stripe’s standard payout rules apply.

What’s the difference between Stripe and WeTravel holds?

Stripe payout delays are predictable (first payout, rolling reserves). WeTravel holds are often unexplained. With SquadTrip, you deal only with Stripe, no extra layers.

Is there an alternative to WeTravel’s payout system?

Yes. SquadTrip + Stripe provides direct, transparent payouts. If you’re still comparing, check our full guide to the 6 Best WeTravel Alternatives in 2025.

Conclusion

For many organizers, wetravel payout issues aren’t just an inconvenience — they’re a business risk. Platform Funds tie up money, Stripe Standard is gated, the verification process drags on, and delayed payouts leave organizers struggling with cash flow.

Cash flow matters. If you can’t access money when you need it, you can’t pay suppliers, issue refunds, or scale your business.

That’s why SquadTrip takes a different approach. We don’t gate Stripe. If you can open an account, you can get paid.